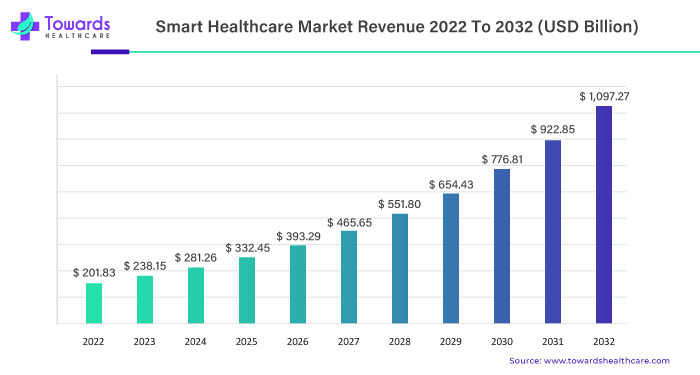

The global smart healthcare market is poised for remarkable growth. Starting at USD 201.83 billion in 2022, this market is anticipated to soar to an estimated worth of USD 1,097.27 billion by 2032, exhibiting an impressive Compound Annual Growth Rate (CAGR) of 18.5% from 2023 to 2032.

Global Smart Healthcare Market: A Comprehensive Outlook

Pioneering Technological Advancements

At the forefront of this growth is the continuous integration of smart technologies into healthcare systems. The global smart healthcare market addresses the increasing need for innovative solutions that enhance patient care, optimize operations, and revolutionize the overall healthcare experience. As technology evolves, so does the potential for comprehensive advancements in healthcare services.

Unveiling the Dynamics of Smart Healthcare Market Size

Beginning at USD 201.83 billion in 2022, the global smart healthcare market is on the verge of transformative expansion. With a projected CAGR of 18.5% between 2023 and 2032, it’s not merely growing; it’s evolving to meet the evolving demands of a technologically-driven healthcare landscape. This trajectory underscores the pivotal role smart technologies play in shaping the future of healthcare on a global scale.

The study states that the growing demand for telemedicine solutions and remote patient monitoring (RPM), both an outcome of the COVID-19 global pandemic, are the primary factors driving the growth of this market. Furthermore, the ongoing development and progress of app-based personal emergency response systems (PERS) will provide the necessary growth opportunities for the industry in the future.

Key Drivers Fueling Market Growth

Enhanced Patient-Centric Care

A key driver propelling the growth of the global smart healthcare market is the focus on enhanced patient-centric care. Smart technologies empower healthcare providers to deliver personalized and efficient care, fostering a more patient-friendly approach. From remote monitoring to real-time data analysis, these innovations contribute to improved patient outcomes and overall satisfaction.

Operational Efficiency through Automation

Smart healthcare market solutions drive operational efficiency through automation. The integration of artificial intelligence, IoT devices, and data analytics streamlines administrative processes, reduces errors, and enhances overall efficiency. This operational optimization not only benefits healthcare providers but also ensures a seamless and responsive healthcare ecosystem.

Proactive Disease Prevention and Management

The market’s growth is further fueled by the proactive role of smart healthcare market in disease prevention and management. From predictive analytics to wearable devices that monitor health parameters, these technologies empower individuals to take charge of their health. This proactive approach not only reduces the burden on healthcare systems but also promotes a culture of preventive healthcare.

Future Landscape and Opportunities

As we look ahead to 2032, the global smart healthcare market presents a landscape teeming with opportunities and challenges. The integration of emerging technologies, ethical considerations, and collaborative efforts within the healthcare ecosystem are expected to define the future of smart healthcare market.

The journey of the global smart healthcare market from USD 201.83 billion in 2022 to an estimated USD 1,097.27 billion by 2032 signifies a transformative era in healthcare. Fueled by technological advancements, this growth promises a future where healthcare is not only smarter but also more accessible, efficient, and patient-centric.

Since the spread of the COVID-19 global pandemic, social distancing and isolation/quarantine has become a new normal. Frequent hospital visits have been discouraged due to the attempts made by governments across the world to contain the spread of the virus. Non-emergency hospital visits were pushed to the background and only emergency cases were handled in hospitals. However, the physiological vital needs of some patients still necessitated routine monitoring so that they could continue to live a normal healthy lifestyle and reduce any emergency visits to hospitals.

Contact-based hospital visits can now be considered non-obligatory owing to the emergence and adoption of various solutions within the Internet of Things (IoT) space. Smart home automation and healthcare systems are some of the outcomes due to the breakthroughs in IoT. The increasing use of smartwatches and the growing adoption of AI, IoT, and telemedicine are expected to open new opportunities within the global smart healthcare market in the near future.

Global Smart Healthcare Market Drivers, Restraints, and Opportunities

Remote patient monitoring (RPM)

- At the beginning of 2020, widespread adoption of remote patient monitoring was still several years away. The technology has been there for a while, but it was having issues taking off. The majority of the concerns concerning the adoption of RPM appeared to be related to the limited reimbursement opportunities and the dearth of incentives for service providers.

- The COVID-19 pandemic made it clear how vital it is for more cutting-edge digital health technology to be immediately embraced. While telemedicine, which is a crucial component of this, has received a lot of attention and funding, RPM has been gaining ground ever since the pandemic started.

Telemedicine

- COVID-19 exposes the utilization of in-person care in the US healthcare system. Despite the fact that the digital health technologies required to support a seamless, anytime, everywhere health ecosystem have been around for more than a decade, there hasn’t been much of a push for patients, doctors, and healthcare organisations to adopt them until recently. In the short term, the transition toward digitally enabled remote care has already altered the way that care is delivered.

- For instance, in April 2020, 43.5 percent of Medicare primary care appointments were made via telemedicine, up from less than 1 percent in February (0.1 percent). What is not clear is whether the growth of telemedicine has made patients and doctors more amenable to virtual therapy in the future or if it will speed the transition of healthcare organisations to a smart health ecosystem.

- The COVID-19 initiative hastened the adoption of health technology while shattering preconceived notions about what it will take to develop a digitally-first healthcare system in the United States. As a result, telemedicine will soon become more “sticky,” and people will be more open to use advanced medical technology in the future. These problems are not just present in the US. Virtual care has become more prevalent throughout the world, and nations are now in a position to reimagine their health systems as a physical and virtual ecosystem.

Cybersecurity Issues

- Criminals looking for their next victim online have started to focus on the RPM environment. Patients and healthcare workers are both concerned about security breaches. Despite the low numbers (44 violations out of 700,000), there might be a significant increase if remote patient monitoring becomes more popular. Despite the robust cybersecurity systems on many platforms, the nascent field of telemedicine may turn out to be the weakest link.

- The majority of patient monitoring systems have historically been carried out in well regulated environments, such as medical facilities. As RPM is implemented in a patient’s home, new dangerous paths have become available because it has developed more quickly than technology. As a result, data transmission and collecting will be less secure.

- Remote access to all of the data necessary for telehealth and RPM services must be done in a safe and secure manner. It also carries a high degree of risk in the field of cybersecurity. To secure personal information, it’s essential to adhere to cybersecurity precautions, in particular FDA regulations and HIPAA compliance. Breach examples include ransomware, unpatched servers, phishing scams, unsafe remote desktop connections, and third-party vendors.

Opportunities in App-Based Personal Emergency Response Systems (PERS)

- Since the middle of the 1980s, personal emergency response systems (PERS) have become much more widespread and user-friendly. PERS is now more accessible to anyone who wants to gain independence without sacrificing personal safety. They were initially intended for elderly people who lived alone and had health issues. The most common type of PERS was a battery-operated personal emergency alert device, such a pendant necklace or bracelet.

- These emergency response systems are being created in a different approach now. Smartphones, which are always with us and include contemporary technology like voice assistants, GPS, and cellular communications, are gradually replacing dedicated alarm devices of the past. A smartphone with software in the form of an app can then be enhanced with additional app-based features, connected with a Bluetooth alert button, or finally replaced with a newer model to make it into a potent personal emergency response device.

- An app-based personal emergency response system has numerous advantages. By making use of the benefits of mobile technology, they also promote greater freedom. App-based PERS, in contrast to older PERS, which could only be used with fixed landlines, may be used everywhere there is cell coverage. Since no new emergency response system hardware is needed, they are also less expensive. In the near future, new growth prospects for the smart healthcare market are anticipated to be made possible by advancements in PERS software.

Smart Healthcare Market Prediction in Terms of Product Types

Some of the product categories in smart healthcare market include RFID Smart Cabinets, RFID Kanban Systems, Electronic Health Records (EHR), mHealth, Telemedicine, Smart Syringes, and Smart Pills. Due to its wide range of applications in various facets of the global healthcare system, telemedicine currently commands the highest revenue share and will likely continue to do so. It will also experience the fastest growth during the projection period, with a CAGR of 25.42 percent.

Global demand for telemedicine technologies has significantly increased as a result of the current pandemic. Recently, hospitals and clinics have boosted their spending in telemedicine services, and numerous insurance companies have included similar options in their policies.

In the global smart healthcare market, the RFID Kanban systems category is also predicted to experience moderate growth. The operating cost of healthcare organizations is frequently significantly increased by inadequate and improper inventory control.

RFID Kanban systems are becoming more widely used in hospitals and other healthcare facilities throughout the world because to their successful reduction in the amount of staff needed for inventory control, outstanding log-keeping results, and overall cost-effectiveness. Additionally, lowering the price of RFID tracking systems is encouraging an increase in their use.

Geographic Footprint of the Smart Healthcare Market

The global smart healthcare market is led by North America and Europe. The quick commercialization of cutting-edge technologies is the key characteristic of the European market. A crucial aspect of the European healthcare sector is the swift mainstream adoption of the most recent medical technologies. The EU’s favorable reimbursement policies also facilitate the quick adoption of cutting-edge treatments and medical technologies there.

High healthcare costs, better reimbursements, and increased knowledge are the main factors driving the North American market, which closely follows the example set by Europe.

The main characteristic of the smart healthcare market in North America is the presence of a strong healthcare infrastructure. The rapid adoption of linked healthcare in North America has been made possible by a supportive healthcare infrastructure that can accommodate the newest medical technologies, more robust economic conditions, and improved awareness. The widespread use of cellphones and internet access in the area is another factor contributing to North America’s leading position.

Due to this, there has been a substantial uptake of fitness apps in the area, and it is predicted that over the course of the projection period, there will be a progressive change in the usage toward medical applications used for health monitoring, treatment, and adherence. With the addition of cutting-edge technology that enable real-time communication, monitoring, and better treatment outcomes, telemedicine and mHealth will continue to expand in the North American market.

The European smart healthcare market is anticipated to increase as a result of rising demand for high-quality healthcare, increasing healthcare spending, and the growing need to rein in rising healthcare prices. With the help of a supportive legislative environment that allows for the quick and effective commercialization of cutting-edge technologies, Europe has historically been the region that adopts the newest medical innovations first.

Applications for remote healthcare have been recognized by European governments as affordable alternatives to traditional healthcare. Governments and private organisations have worked to raise awareness of telemedicine’s advantages in the area. With more nations providing reimbursements and benevolent rules, the European market has been developing.

Additionally, the European Commission has been working to increase the region’s use of high-speed internet. However, due to infrastructure and safety considerations, healthcare IT solutions have historically found poor deployment in Eastern Europe. While Eastern Europe is increasingly catching up to regional trends, Western Europe now dominates the European smart healthcare market.

The region with the fastest rate of growth for smart healthcare market is Asia Pacific. Improvements in healthcare infrastructure and expanding healthcare infrastructure in developing economies are credited with driving the rapid expansion of the Asia Pacific industry. Due to the region’s enormous population, it is constantly looking for new technologies to handle the high patient volumes, which is why intelligent healthcare solutions are a good fit.

Due to the country’s quick development and infrastructure’s gradual growth, China dominates the region. Other important markets in the Asia-Pacific region include Japan, which has already reached the stage of maturity, India, where the healthcare infrastructure is developing quickly, Australia, where initiatives are moving forward quickly, and other nations that are still in the early stages of developing their healthcare systems.

Company Positioning in the Global Smart Healthcare Market

The smart healthcare market ecosystem is broad in nature and includes a number of players who cater to various areas, including RFID, mHealth, telemedicine, and EHR, among others. Several big and small companies with a local and/or regional reach often dominate the market sector.

For instance, after receiving regulatory permission, mHealth apps are offered on the Apple Store and Google Play. However, there are specific regulatory regulations for data protection that must be met by mHealth apps that support patient and hospital engagement. The regulatory approvals for telemedicine systems are also diverse. The businesses operating in each of these segments of the smart healthcare market could vary since they serve various ecosystem vendors. Thus, the global smart healthcare market is highly fragmented.

Some of the companies with a notable footprint in the global smart healthcare market include Allscripts Healthcare Solutions Inc., LogiTag Systems, Cerner Corporation, Samsung, Cisco Systems, GE Healthcare, Siemens Healthineers, IBM Corporation, Becton, Dickinson and Company (BD), Terumo Corporation, eClinicalWorks, Stanley Healthcare, and Medtronic. These companies have been focusing on various strategies to increase their footprint in this market space. For instance,

- Allscripts Healthcare, LLC and Revo Health, LLC (Revo) established a partnership in April 2021 to offer Payerpath and Allscripts Practice Management to all of its Infinite Health Collaborative (i-Health) clinics, assisting in enhancing their financial and operational performance. The electronic health record system TouchWorks® from Allscripts and the patient engagement tool FollowMyHealth® from Allscripts are both currently used by i-Health.

- Kantar Health, a branch of Kantar Group, was purchased by Cerner Corporation in April 2021 for USD 375 million.

- 12 behavioral health facilities throughout the Commonwealth of Virginia received access to Cerner Corporation’s electronic health record (EHR) starting in January 2021, according to the company’s announcement.

- Samsung Electronics declared in April 2021 that it would reuse obsolete cell phones to improve access to eye healthcare in underprivileged areas of the world. By recycling outdated Galaxy smartphones, Samsung collaborated with the Yonsei University Health System (YUHS) and the International Agency for the Prevention of Blindness (IAPB) in Korea to develop medical devices that screen for eye diseases. With the right diagnosis, there are around 1 billion cases of vision impairment that can be avoided. This Galaxy Upcycling program is assisting in addressing these cases.

- In order to support the government’s more comprehensive and inclusive pandemic recovery measures, Cisco and the government of Japan began working together in February 2021 on large-scale digitization projects. The partnership supports Japan’s Society 5.0 goal, which aims to accelerate digitization across all industry verticals and sectors, including business, government, education, and healthcare.

- Moderna and IBM declared in March 2021 that they intended to investigate cutting-edge COVID-19 vaccination management technologies such hybrid cloud, blockchain, and artificial intelligence.

- In May 2021, BD (Becton, Dickinson and Company) announced plans to erect a high-tech manufacturing facility in the Spanish city of Zaragoza that will cost EUR 165 million (USD 200 million) and generate up to 600 jobs by 2030.

- The collaboration between Terumo Blood and Cell Technologies and CSL Plasma to introduce a new plasma collection technology at CSL Plasma’s U.S. collection facilities was announced in April 2021.

- The successful rollout of eClinicalWorks’ Vaccine Administration Management Solution (VAMS), which supports the delivery of COVID-19 vaccine doses across 29 US states, was announced in April 2021. Healthcare providers were helped with effective COVID-19 vaccination delivery through the eClinicalWorks VAMS.

- Medtronic Plc announced in May 2021 that their SonarMedTM airway monitoring system would begin commercial selling in the United States.