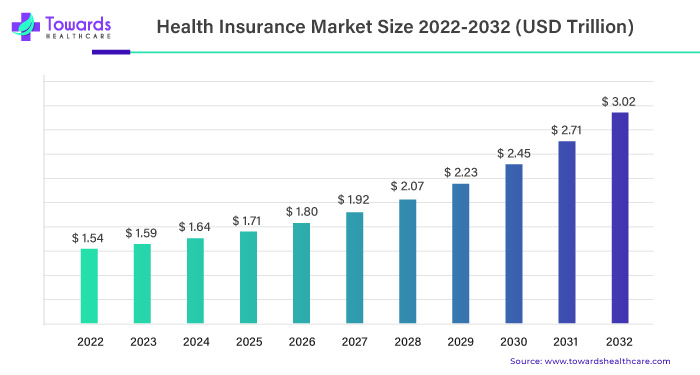

The trajectory of the health insurance market is poised for remarkable growth. Witnessing an anticipated surge, the market is projected to elevate from its 2022 valuation of USD 1.54 trillion to an impressive USD 3.02 trillion by the year 2032. This substantial increase is attributed to a compelling Compound Annual Growth Rate (CAGR) of 7.4% predicted between 2023 and 2032. Let’s delve into the driving forces behind this unprecedented rise and the pivotal role played by healthcare expenditure and comprehensive coverage benefits.

Report Highlights:

- The escalating cost of medical services and its impact on the expanding health insurance market.

- The Impact of limited awareness on health insurance market growth.

- Funding for new technology and innovation in the industry is opening up new opportunities.

- Medical insurance shows substantial growth in the health insurance market.

- The global health insurance market premiums reached around USD 1.54 trillion in 2022

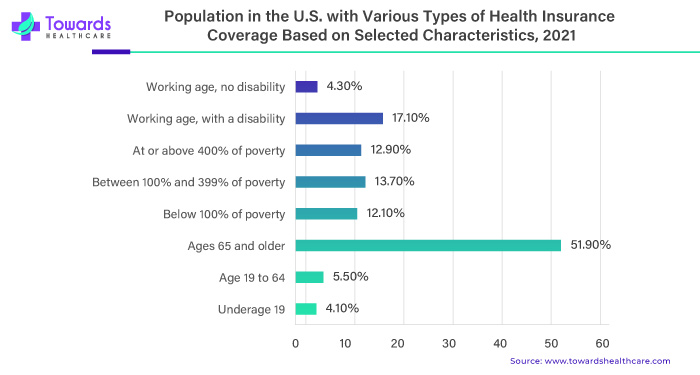

According to the American Community Survey (ACS) 1-year estimates, twenty-seven states had a greater percentage of individuals with health insurance coverage in 2022 than in 2021. From 2021 to 2022, 13 states reported improvements in public coverage, with only Rhode Island reporting a 2.2 percentage point reduction.

As one of the main tools for attaining social equity in the healthcare structure, health insurance market promotes access to essential medicines and healthcare services, protecting people’s fundamental rights to life and reaching universal health goals. By actively encouraging the use of pharmaceuticals and medical services, health insurance directly impacts pharmaceutical sector investment and stimulates innovation. Health insurance market is critical for pharmaceutical modernization by ensuring access to required pharmaceuticals. Pharmaceutical innovation refers to discovering and developing novel medicines through preclinical testing, clinical trials, scientific research, and drug design.

Understanding disease molecular pathways, finding possible therapeutic targets, and generating new chemical entities capable of treating, preventing, or managing various diseases are all part of the process. By providing patients with greater efficacy as well as safer treatment alternatives and allowing healthcare systems to provide individualized and cost-efficient care, pharmaceutical innovation improves the overall efficiency of health insurance market systems and population health outcomes. It lowers financial obstacles and encourages pharmaceutical businesses to invest in research and development. Health insurance market effectively bridges the gap between affordability and medical discoveries, producing a dynamic market that encourages innovation.

For Instance,

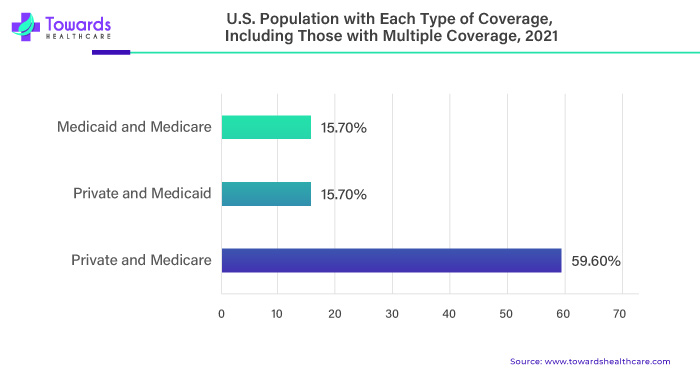

- In 2020, over 163 million Americans, or half of the US population, were covered by employer-provided health insurance through their job or as a dependent. Nearly 60% of businesses provide health insurance to at least some employees. Employer-sponsored insurance covers a larger population than any other type of health insurance market in the United States, and it is diverse in terms of age, ranging from employees’ children to mid-career adults to those nearing retirement.

Changes in health insurance market significantly impact patients, payers, and providers. From the patient and payer’s standpoint, a higher health insurance market concentration may diminish health plan options and increase premiums. For providers, this can potentially erode bargaining power reimbursement negotiations and limit anatomy in practice; understanding how health insurers respond to market pressure and influence premiums has become a crucial aspect of the U.S. healthcare sector. The evolution of the market, influenced by these factors, has seen a notable increase.

Changes in health insurance market significantly impact patients, payers, and providers. From the patient and payer’s standpoint, a higher health insurance market concentration may diminish health plan options and increase premiums. For providers, this can potentially erode bargaining power reimbursement negotiations and limit anatomy in practice; understanding how health insurers respond to market pressure and influence premiums has become a crucial aspect of the U.S. healthcare sector. The evolution of the market, influenced by these factors, has seen a notable increase.

Insurer dynamics, market forces, and regulatory changes have led to a more complex landscape. Policymakers, recognizing the need for additional evidence, have called for comprehensive studies. In response to such calls, a recent study revealed that 57% of U.S. metropolitan statistical areas were experiencing notable shifts in their healthcare markets, further emphasizing the importance of ongoing research and analysis in this dynamic field.

The Escalating Cost of Medical Services and its Impact on the Expanding Health Insurance Market

The rising costs of surgeries, hospital stays, and medical services have caused a global financial crisis. Health insurance market provides critical financial assistance in the event of a severe illness or accident. Surgical expenses, doctor fees, hospitalization costs, emergency room charges, and diagnostic testing fees are all included in the cost of medical services. The rising cost of medical services has fueled the expansion of the health insurance market.

For Instance,

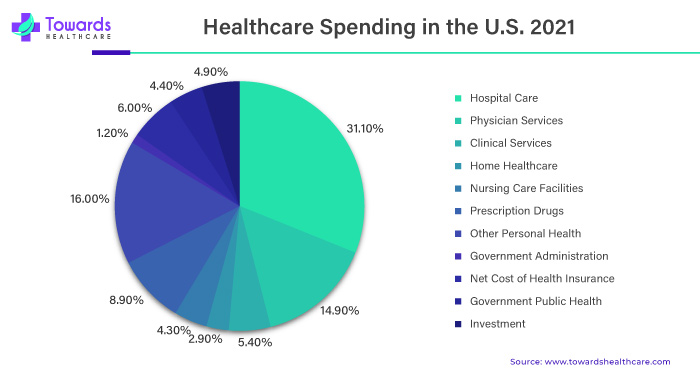

- According to the World Health Organisation, Americans now spend an average of approximately $13,000 per year on healthcare.

- In 2023, According to the Centers for Medicare and Medicaid Services, healthcare spending is expected to increase by 5.1% from $4.2 trillion in 2022.

- In 2021, according to the Commonwealth Fund, Healthcare costs in the United States have risen dramatically over the last several decades. Healthcare spending as % of GDP increased from 8.2% in 1980 to 17.8% in 2021.

The rising cost of medical services is a global concern, driven by factors such as advanced technologies, increasing demand for healthcare, and rising pharmaceutical expenses. This trend puts pressure on the health insurance market as they strive to cover these expensive services. As medical costs rise, healthcare insurance premiums often increase to accommodate these expenses. Insurance providers face the challenge of balancing coverage affordability for policyholders while ensuring they can meet the financial demands of expensive medical treatments and procedures.

This delicate equilibrium is crucial to sustaining a viable health insurance market. The impact on the expanding health insurance market includes potential barriers to access for individuals without coverage due to rising premiums. Additionally, insurers may adopt strategies such as adjusting coverage terms, implementing cost-sharing measures, or exploring innovative models to manage expenses. Policymakers play a role in addressing these challenges through regulations, subsidies, and initiatives to promote cost-effective healthcare delivery.

In conclusion, the escalating cost of medical services significantly impacts the expanding health insurance market, influencing premiums, coverage terms, and access to care. Effective solutions require a balance between providing comprehensive coverage and managing the financial sustainability of insurance programs.

The Impact of Limited Awareness on Health Insurance Market Growth

The need for more awareness regarding healthcare insurance significantly restrains the market’s growth in several ways. Limited awareness means a lower demand for insurance products, as individuals may need to fully understand the benefits or underestimate the importance of health coverage. This leads to a smaller customer base and reduced market expansion; inadequate awareness contributes to a lack of understanding about the diverse range of insurance plans available, preventing potential policyholders from making informed decisions. This hampers market growth as consumers may need help finding suitable plans tailored to their needs, further dampening overall demand.

Additionally, the lack of awareness can result in delayed or foregone preventive healthcare measures. Individuals may need to be aware of the advantages of regular check-ups and early intervention, potentially leading to higher healthcare costs in the long run. This impacts the insurance market by increasing the prevalence of more expensive and severe health issues, negatively affecting insurers and policyholders.

Furthermore, a lack of awareness may contribute to scepticism about the value of healthcare insurance, with individuals questioning the necessity of paying premiums. This scepticism can create a barrier to market entry for insurance providers and hinder the development of a robust and competitive insurance landscape.

Addressing this issue requires targeted education campaigns to raise awareness about the benefits of healthcare insurance, the range of available plans, and the importance of proactive healthcare management. Increased awareness expands the market by attracting more customers and fosters a healthier and more financially sustainable healthcare system.

Funding for New Technology and Innovation in the Industry is Opening up New Opportunities

InsurTechs in the United States have benefited from a rich and competitive VC funding market, and many insurance start-ups have successfully completed some funding rounds. However, in markets with no strong VC culture, the approach to raising capital will be different, with public sources becoming more important.

For Instance,

- French start-up InsPeer receives funding from a variety of public sources.

- Several broader technological developments and innovations support many InsurTech developments. Some of the technologies are interconnected, and a brief overview can help establish a shared understanding of their nature.

- Mobile technology and applications(apps), for example, The network effect of mobile phones, as well as the development application of this device (referred to as “apps”), has enabled many businesses to reach a larger audience than was previously possible. Depending on the generation of mobile networks available and the types of handsets most commonly used, mobile technology may work differently for InsurTech.

- Smartphones and internet access enable app-based innovations to flourish. Mobile networks that allow short messages and prepaid. Large data volumes are useful for this. As in the BIMA (mobile phones have the ability to notify individuals via SMS on anything from insurance coverage to reminding them of the imminent withdrawal of airtime for premium payments.

Algorithms, artificial intelligence (AI), and robo-advice AI refers to machine intelligence. A machine is deemed “intelligent” when it evaluates its surroundings and takes action to maximize its chances of reaching its stated goal. It is commonly utilized for developing computer programs with cognitive characteristics such as learning and problem solving. AI research is being conducted in areas like as reasoning, knowledge, planning, learning, natural language processing, perception, and object movement/manipulation.

Innovation and technologies in the healthcare insurance market create synergy beyond traditional insurer-provider relationships. They enable value co-creation, leading to more comprehensive, efficient, and consumer-centric healthcare insurance solutions.

Medical Insurance Shows a Substantial Growth in the Health Insurance Market

Medical insurance is a safety net, covering a substantial portion of individuals’ healthcare expenses. This financial security encourages people to seek necessary medical services without fearing high out-of-pocket costs. By mitigating financial risks associated with healthcare, insurance companies instil confidence among policyholders, thereby supporting expanding the health insurance market. Many medical insurance plans include preventive services like vaccinations, screenings, and wellness programs. These initiatives aim to detect and address health issues early, promoting overall well-being.

The emphasis on preventive care enhances individual health and contributes to long-term cost savings for both policyholders and insurance providers, fostering sustainability in the health insurance market. Medical insurance enhances the accessibility of healthcare services for a broader segment of the population. Individuals with insurance coverage are more likely to seek timely medical assistance, preventing the progression of illnesses and reducing strain on healthcare resources. Improved access to healthcare services leads to increased demand for insurance products, driving market growth as more people recognize the value of coverage.

Insurance plans often come with a network of healthcare providers, ensuring that policyholders can access various medical professionals and facilities. This promotes the delivery of quality healthcare services. The collaboration between insurance companies and healthcare providers establishes a symbiotic relationship, with insurers incentivizing providers to deliver efficient and effective care. This collaboration enhances the overall quality of healthcare services in the market. The demand for medical insurance stimulates innovation within the insurance market.

Insurers differentiate themselves by offering unique coverage options, personalized plans, and technological solutions to enhance the customer experience. Intense competition among insurance providers fosters market growth as companies continually strive to improve their offerings and attract a more extensive customer base. In summary, medical insurance acts as a catalyst for the growth of the healthcare insurance market by addressing financial concerns, promoting preventive care, enhancing accessibility, fostering quality healthcare, and driving innovation and competition within the industry.

Geographical Landscape

In 2022, North America dominated the world health insurance market. This segment has grown due to North America’s higher health insurance penetration rate. In North America, healthcare expenditures and costs are incredibly high. Most people rely on their medical insurance to pay for their treatments. In addition, a significant market like the United States has a very high prevalence of chronic diseases. An estimated 60% of Americans are thought to be afflicted with one or more chronic illnesses.

The primary causes of the high cost of healthcare are the availability of sophisticated infrastructure for healthcare and easier access to these facilities. The primary drivers of the health healthcare market’s explosive expansion are the region’s high literacy rate and the general public’s growing awareness of the advantages of insurance policies.

Asia-Pacific is anticipated to grow at the fastest rate during the projected period. The world’s population is concentrated in the Asia Pacific region. The insurance industry’s increasing penetration and quick urbanization expand the market. The leading causes of the region’s rising chronic disease prevalence are changing consumer lifestyles, poor eating habits, and an increase in obesity.

The most notable factors that are anticipated to propel the growth of the Pacific region of Asia health insurance market in the upcoming years are rising disposable income, expanding internet access, rising level of literacy, increasing investments in the construction of cutting-edge healthcare infrastructure, and growing public awareness of health insurance market.

For Instance,

- In 2022, Life Insurance Corporation of India’s initial public offering (IPO) was the largest ever in India and the fourth largest IPO globally—the listing accounted for more than 3rd of the resources mobilized in the primary resource market.

The Momentum: An Overview of Growth Factors

1. Escalating Healthcare Expenditure

As the global population continues to prioritize health and well-being, there is a corresponding upswing in healthcare expenditure. The increasing awareness of preventive healthcare measures and advancements in medical technologies has led individuals and governments alike to allocate more resources to health-related expenditures. This burgeoning investment acts as a catalyst, propelling the health insurance market to new heights.

2. Extensive Coverage Benefits

One of the cornerstones of this transformative surge is the expansive coverage benefits offered by health insurance market policies. These policies serve as a safety net, providing financial support and peace of mind against a myriad of medical conditions. The comprehensive nature of these coverage plans resonates with individuals, fostering a sense of security and prompting a surge in demand for health insurance products.

Navigating the Landscape: The CAGR Phenomenon

The heart of this growth narrative lies in the impressive Compound Annual Growth Rate (CAGR) of 7.4%. This metric encapsulates the year-over-year expansion of the health insurance market between 2023 and 2032. It signifies a sustained, robust growth pattern that underscores the industry’s resilience and adaptability in the face of evolving healthcare landscapes.

Looking Ahead: Projected Milestones

1. Technological Integration

The future of health insurance market is intricately linked with technological integration. The industry is set to embrace cutting-edge technologies such as telemedicine, artificial intelligence, and data analytics. This not only enhances the efficiency of healthcare delivery but also contributes to a more streamlined and accessible health insurance experience for consumers.

2. Tailored and Specialized Plans

To cater to the diverse and evolving healthcare needs of individuals, insurance providers are expected to offer more tailored and specialized plans. This shift towards customization ensures that consumers can choose plans that align precisely with their unique health concerns, fostering a sense of personalized care within the insurance landscape.

The surge in the global health insurance market is a testament to the intrinsic link between healthcare expenditure, coverage benefits, and industry growth. As we traverse the path from a USD 1.54 trillion valuation in 2022 to an estimated USD 3.02 trillion by 2032, the landscape is evolving dynamically. Embracing technological advancements and catering to individualized needs, the health insurance market is not just expanding; it’s redefining the contours of healthcare protection on a global scale.

Competitive Landscape

Companies investing in innovative healthcare solutions contribute to industry growth, as their advancements create new opportunities and increase the overall demand for healthcare insurance from emerging Tech firms and collaborations with healthcare providers. As technological advancements continue, companies are exploring data analytics, telemedicine integration, and personalized coverage options to gain a competitive edge. Regulatory compliance, customer experience, and strategic partnerships also play pivotal roles in shaping the dynamics of the healthcare insurance sector.

Recent Developments

- In June 2021, Anthem, Inc. The company acquired MMM Holdings, Inc., enabling them to offer Medicaid and Medicare plans to consumers in Puerto Rico.

- In April 2021, Molina Healthcare, Inc. made a deal with Cigna Corporation to acquire Cigna’s plans for Medicare Medicaid and Texas Medicaid.

- In June 2021, Vitality announced that it partnered with Samsung UK to incorporate Samsung Health into the Vitality Programme, giving participants additional tools to monitor their activity and enhance their health. With the new partnership with Samsung, Android users can take advantage of all the benefits of the Vitality Programme. Members can earn Vitality activity points by automatically capturing daily steps and heart rate activity and linking their Samsung Health profile to their Vitality Member Zone account.

- In 2023, Ayushman Bharat (Pradhan Mantri Jan Arogya Yojana) (AB PMJAY) aims to provide health coverage of 5 lakh per family year for secondary and tertiary care hospitalization.

Market Players

- Cigna Corporation

- CVS Health Corporation

- Allianz

- Centene Corporation

- United Healthcare Services, Inc.

- National Insurance Company Limited

- Bupa Global

- Humana, Inc.

- AIA Group Limited

Market Segment

By Provider

- Public

- Private

By Coverage Type

- Term Insurance

- Lifetime Coverage

By Network Provider

- Point of Service

- Preferred Provider Organization

- Exclusive Provider Organization

- Health Maintenance Organization

By Plan Type

- Medical Insurance

- Critical Illness Insurance

- Family Foster Health

- Insurance

- Others

By Age Group

- Minor

- Adults

- Senior Citizen

By Distribution Channel

- Direct Sales

- Brokers/Agents

- Banks

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa